Turn scattered risk data into a system you can actually trust.

The problem we kept seeing

Pools running on outdated, rigid systems that no longer fit how they operate.

Vendors who stopped listening and made even small changes feel impossible.

Teams stuck in spreadsheets and workarounds just to get through renewals and audits.

What we decided to build instead

We built RiskPoolPro in partnership with pool administrators, operations managers, and IT leaders — people who live in these systems every day.

Our focus: clarity, transparency, and long-term sustainability. Software that simplifies complex operations instead of adding layers of vendor dependency and technical debt.

"Software should simplify complex operations — not complicate them."

What RiskPoolPro gives you

Clarity

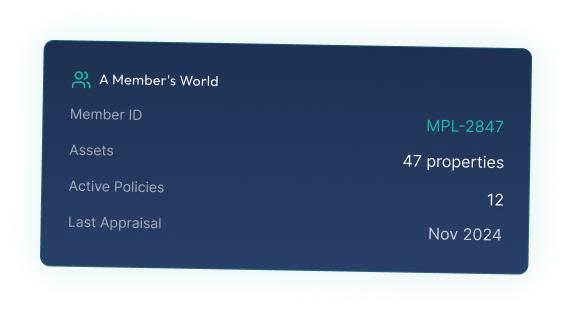

One place for members, assets, policies, and coverage.

No more hunting across spreadsheets, file shares, and legacy tools.

Members · Assets · Policies · Snapshots

Control

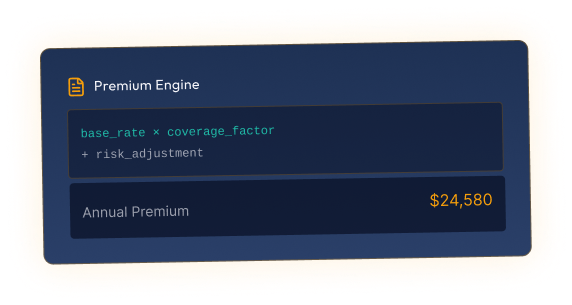

Dynamic premium engine, snapshots, and audit trails you can depend on.

Change formulas, run scenarios, and compare versions without vendor tickets or lockouts.

Formulas · Scenarios · Snapshots · Compare

Confidence

Transparent reporting and oversight-ready documentation for boards and auditors.

Show your work, prove your process, and give stakeholders the visibility they expect.

Reports · Audit Trail · Board View · Export

One place for members, assets, policies, and coverage.

No more hunting across spreadsheets, file shares, and legacy tools.

Dynamic premium engine, snapshots, and audit trails you can depend on.

Change formulas, run scenarios, and compare versions without vendor tickets or lockouts.

Transparent reporting and oversight-ready documentation for boards and auditors.

Show your work, prove your process, and give stakeholders the visibility they expect.

How it actually works

(without the vendor maze)

Configure your pool

Configure your poolAlign terminology, roles, and workflows with how your pool already operates. Not the other way around.

Bring your data forward

Bring your data forwardAssets, policies, appraisals, and premiums — migrated and structured to make sense for your next decades, not just your last system.

Run your program with support you can see

Run your program with support you can seeThe same team that built the platform supports your implementation, training, and ongoing improvements — no anonymous handoffs.

For the people doing the work

Insurance Pool Administrator

"I need a system I can defend to our board."

Clear audit trails, controllable formulas, and real data ownership.

Operations / Member Services

"I'm the one who actually lives in this system."

Intuitive workflows that match how you work, not how a vendor thinks you should.

IT Leader

"I need to know this won't break or box us in."

Modern architecture, clear data ownership, and a roadmap you can influence.

Oversight / Governance

"I need proof the system supports compliance, not just features."

Transparent reporting, audit-ready documentation, and board-level visibility.

What changes when you switch

Real improvements in how you manage risk and serve your members

Before RiskPoolPro

Legacy platform with freeze periods during critical cycles

Brittle reports that require manual spreadsheet work

Poor support, slow roadmaps, and unclear ownership

With RiskPoolPro

On-demand snapshots with no system lockouts

Dynamic formulas that admins can adjust without vendor tickets

Responsive support from the team that actually built the platform

Configurable workflows aligned to how your pool works in the real world

Our first implementation proved the model: work side-by-side with real pool admins, refine the platform in the field, then bring that maturity to every new client.

If you're running an insurance pool or risk‑sharing group and your current system is holding you back, let's talk about what a migration could actually look like.

No pressure, no hard sell — just a working session to see if this fits.